Athleisure – a hybrid of athletic and leisure apparel to create a contemporary style of clothing – has become a lucrative market. According to a report from Morgan Stanley Research, athleisure is now worth more than £194 billion globally. Sports giants such as Nike, adidas and Under Armour originally led the way in athleisure apparel, but high-street brands are now offering their own athleisure clothing. Even companies operating outside the retail space are stepping into the arena, with workout and gym brands promoting their own athleisure fashion lines.

The rapid growth of athleisure shows no sign of abating, creating potential opportunities for brands to expand and grow in international markets. Enlisting the expertise of Oban International’s LIME (Local In-Market Experts) network, we conducted a review to identify general perceptions of athleisure brands and the key elements that are required for athleisure to be successful in different markets.

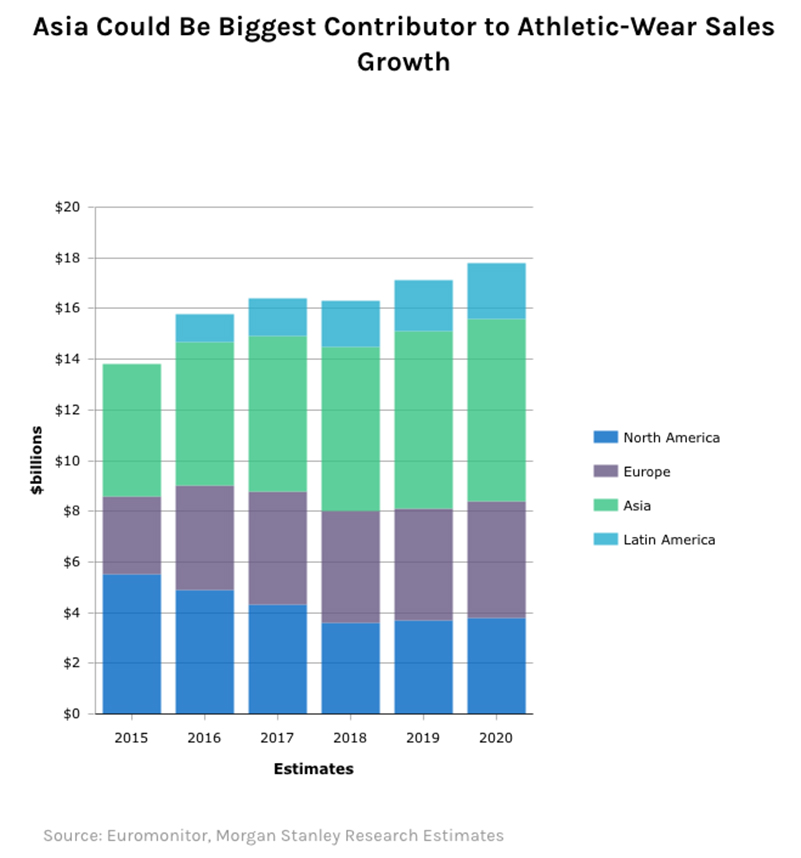

Findings from our report revealed there is strong appetite for athleisure apparel in countries such as Brazil, Japan, India and China, where e-commerce and cross-border purchasing is established. Additionally, there are growth opportunities in the less well established markets of Argentina, Mexico and Thailand. The review highlighted four factors which are contributing to the success of the athleisure trend and the opportunities for its international e-commerce growth.

1. Millennials are the driving force

A consistent characteristic of athleisure’s popularity, particularly in the US, is that it is largely driven by Millennials. In the US, there has been a shift among Millennials towards flexible working, which has created an acceptance of a more casual dress code in the workplace and the rise of athleisure. Unlike past generations, US Millennials are more liberal in their outlook on life and therefore less strict about adhering to social conventions.

To capture the attention of Millennials, it important to build strong communities of fans in this age group. Marketers should use data capture to establish regular points of communication and a tailored digital strategy to support this.

Moreover, digital channels, including social media, should be used to communicate a clear and authentic message and promote engaging content. Marketers must understand which platforms are most important in each market, and how and when they are used. Investing in paid social campaigns can be a valuable part of an integrated campaign to raise brand awareness and drive sales.

2. The health-conscious middle-class

Athleisure’s enormous popularity is a direct result of the wellness trend among the global population and consumers’ increased awareness of health. More than just a physical activity, exercise has become part of an aspirational lifestyle. Feedback from our local market experts suggests that there are opportunities to promote the athleisure lifestyle in Brazil, China and Mexico.

Despite the damaging impact of the global economic crisis in Brazil, the middle class has grown to 50 million. Health has become a massive priority and consumers are willing to invest in it.

This preoccupation with health and fitness is also evident in China and Mexico. In China, where the e-commerce market is mature, consumers are not only wealthier but have become more conscious of maintaining a healthy lifestyle. Likewise, in Mexico, living a healthy lifestyle has become popular, particularly among young people, due to the popularity of gyms and athletes who often flaunt their active lifestyle and fashion choices on social media channels.

3. Competition from native players

Although the West currently dominates the athleisure space, there is increasing competition from emerging native brands. The widespread adoption of healthy living and fitness activities has given native brands a chance to capitalise on athleisure fashion.

In Brazil, the athleisure trend has become so popular that national clothing brands such as Animale are producing their own athleisure apparel. However, native brands won’t necessarily compete with international brands. In China, local brands with their own athleisure clothing lines are targeting a lower price point rather than competing with high-end global brands like Nike. Competition from native brands is not yet an issue in less developed markets such as Mexico. To penetrate new markets or grow existing e-commerce opportunities in these markets, athleisure brands should develop a comprehensive strategy to drive brand awareness and engagement.

4. Cultivate local influencers

A noticeable aspect of the athleisure boom is the significant role of celebrity and influencer endorsement. Celebrities like Beyoncé, with her Ivy Park clothing line, and Selena Gomez endorsing adidas’s teen-focused NEO label, are just two examples of how integral celebrity and influencer culture is to the athleisure market.

Input from our LIME network has shown that celebrity endorsement of athleisure brands is important in all markets. In Thailand, many celebrities wear athleisure clothing and regularly post their workout photos on Instagram, the country’s favoured social media platform.

One of our Mexico LIMEs, Berenice, highlights that influencers are propelling the popularity of athleisure: “(These) influencers and a lot of advertising of famous people should (improve visibility) for international brands.”

In China this holds true, too. Jing Du, one of our China LIMEs, explains: “The best and fastest way to bring visibility is to find and use a popular sports star.”

Growing athleisure brands: top takeaways

The athleisure trend is set to stay. As middle-class populations grow internationally, it presents a wealth of emerging markets for brands to embrace. These opportunities will only increase as the focus on healthy living spans generations.

Ultimately, despite the unprecedented growth of the athleisure market, the majority of the spend still remains in the traditional Western markets of the US, UK and Europe. However, change is afoot. Where emerging economies are on a positive trajectory with people becoming more affluent, the doors to athleisure brands will continue to open as the desire for more aspirational, international brands builds.

There is no one-size-fits-all approach to launching or expanding an athleisure brand into a new market. Having a sensitive awareness of local cultural nuances and economic circumstances, combined with a tailored digital marketing strategy, will help athleisure brands drive both awareness and sales on the international stage.

Read the full report from Oban, here.

Read also:

Intricacies of B2B marketing: case study shows how to boost performance