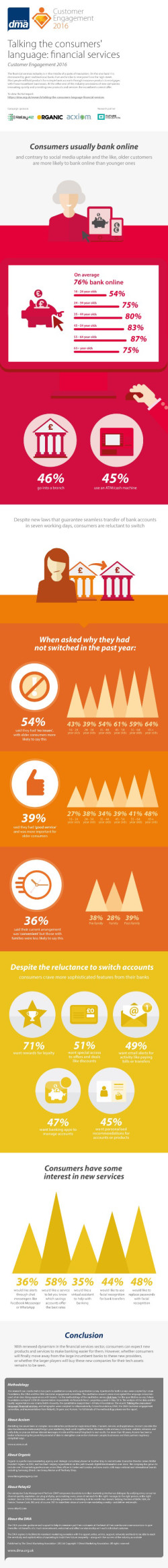

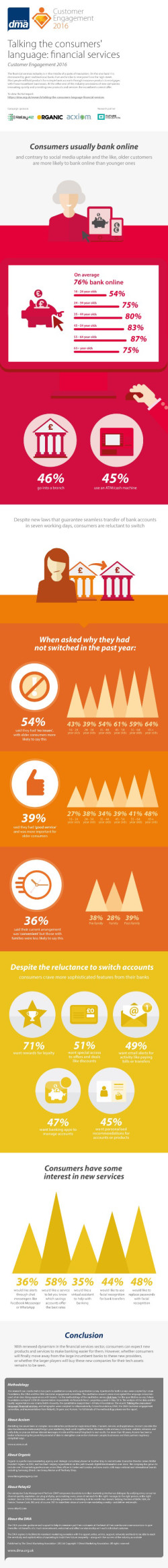

Research shows that 76 per cent of UK customers use online banking and 22 per cent also bank via their mobiles. However, 45 per cent are still visiting their local banks for the traditional one-to-one banking experience.

Research from the UK DMA into innovation within the financial services industry has resulted in the infographic, here.

It comes as part of a Customer Engagement study that looks into which brands are successfully engaging with their customers and why consumers like them.

The research has found that 76 per cent of customers use online banking and 22 per cent also bank via their mobiles. However, 45 per cent are still visiting their local banks for the traditional one-to-one banking experience and they are still reluctant to switch banks – despite new regulation allowing seamless transition – as 62 per cent of them claim they have no reason to change.

But what they would like to enhance their online banking experience is:

- 51% – special access to offers and deals like discounts

- 49% – email alerts for activity like paying bills or transfers

- 47% – baking apps to manage accounts

- 45% – personalised recommendations for accounts or products

A spokesman for the DMA said: “With renewed dynamism in the financial services sector, consumers can expect new products and services to make banking easier for them. However, whether consumers will finally move away from the large incumbent banks to these new providers, or whether the larger players will buy these new companies for their tech assets remains to be seen.”

Leave your thoughts