Craig Hanna explores the "mega trends" that will dictate the future of global retail in this detailed and thought-provoking analysis. So where is physical retail heading? And how can businesses and marketers adapt their strategies to future-proof their brands?

Introduction:

Get ready for change

High street retailers with expensive rent and rates were under pressure before Covid and there will be a growing number that follow the already significant casualty list of major retail brands in the UK and across America.

Yes there will be a post-Covid bump for traditional retailers. But online retailers will keep a significant part of the gains they have made (upward of 10% in many categories). Let’s not forget that there will also be structural changes to where and how people work that are here to stay (which we discussed on an early edition of Global Perspectives).

With less workers in town centres there will be less lunchtime and post-work sales for many stores, bars and restaurants. Retail margins are already low so it doesn’t take much of a shift in sales volume to make it disappear. Landlords should prepare for some very robust price negotiations as leases come up!

However there is another way, one that is probably inevitable, at least in general terms. This future encompasses a smaller high street, one that’s focused on experience not price wars, one that benefits local producers. It doesn’t ignore digital commerce, in fact it embraces it by unpackaging the enjoyable parts of retail from the mundane.

The above requires a mindset change not just from retailers but from local planners, from central government and from all of us. We can approach this the hard way, or the easier way:

- The hard way: A long and painful adjustment ultimately driven by consumers and economics.

- The easier way: A route where appropriate intervention, innovation, education and funding are put in place to both accelerate this change (shortening the painful transition time by decades) and to create safety nets to cushion the financial hardships that will be felt.

Financial hardships are not just those that will be felt by retailers. Local councils and central government will both see reduced income from the “traditional” retail sector, some of which will have to be made up by ensuring online retailers pay their fair share.

Local councils in particular rely on business rates to pay for local services, money that will be significantly reduced in the coming years and will need to be replaced – especially since the finances of all involved will need time to recover from the costs inflicted by the pandemic.

There is no single answer to the challenges ahead and this report is certainly not designed to deliver that level of detail. Rather its aim is to highlight the issues, trends and innovations that are already with us and to help drive the change in mindset that is required.

If all we achieve is a consensus that doing nothing is not the answer and if, in turn, that inspires others to start taking action then we will have been successful.

Contents

-

Predicting the future: processes and pitfalls

-

Key consumer trends and their impact on retail

-

1. The continued rise of digital commerce

-

2. The workplace revolution

-

3. A resurgence in local products

-

4. The growth of Direct-to-Consumer

-

5. The rise of the ethical consumer

-

6. The fifteen-minute city and a new future

Predicting the future: processes and pitfalls

Predicting the future is a task filled with hazards which even the world’s brightest minds armed with unimaginable data and computing power rarely manage to navigate well. You only need to look back at the large number of “prediction” articles from the last 30 years and you will see that the misses significantly outweigh the hits.

Predicting the future is a task filled with hazards which even the world’s brightest minds armed with unimaginable data and computing power rarely manage to navigate well. You only need to look back at the large number of “prediction” articles from the last 30 years and you will see that the misses significantly outweigh the hits.

However, futurologists are often looking for the unknown, for the yet to be realised innovation that will drive a step change in our capabilities. It has its uses: it feeds the imagination of innovators and startup founders.

But we can arrive at a more likely outcome by extrapolating on current trends and known, established technologies. There will still be bias and poor choices but we can at least mitigate some of them.

We started by asking ourselves some questions, which we explore in more detail later in the report.

Given that digital commerce has taken somewhere between 10 and 20% of retail sales (and is likely to continue its erosion of sales volume) do we believe that the high street retail footprint can be as big in the future?

Can the high street compete on price alone given the cost advantages of not paying premium rent?

Can the high street compete on the mundane or the bulky/awkward items that people really don’t want to buy and/or carry given the rise of easy delivery options?

Will office working return entirely to post Covid levels even when a vaccine is rolled out?

Will consumers continue to become more concerned about the ethical and environmental impacts of the products that they buy?

As next generation technology matures and gets embedded will this encourage or discourage town centre shopping?

Will consumers look to purchase more locally, especially where there is a high perceived value for local products such as fresh foods?

If like us you feel that most, if not all, of the above are likely to happen to some degree over the coming months and years, then we are heading quickly towards a very different future for retailers, for the high street and for customers. However this doesn’t have to be all negative. With the right decisions and the right investments, the future of retail could be a much better one.

Mega trends and their impact on retail 2021/22

These are trends that we think will significantly impact the revenue and stability of retailers in the next year or two. Some are already significant, others are in our opinion accelerating quickly to be a key disrupter.

1. Digital commerce will continue to disrupt

Prediction: digital commerce will continue to erode the footprint and sales volume of the physical high street.

Prediction: digital commerce will continue to erode the footprint and sales volume of the physical high street.

The numbers are compelling

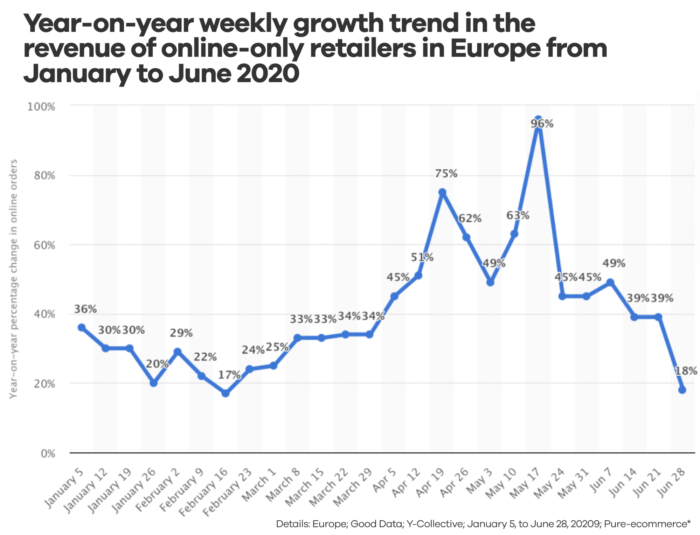

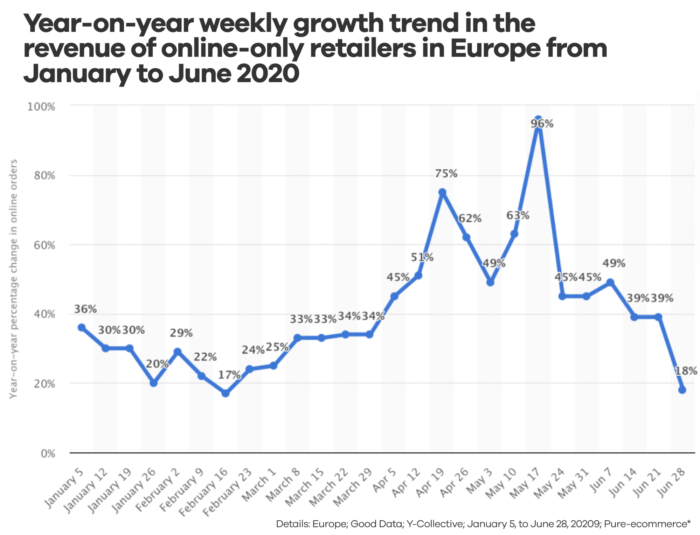

The chart below shows US ecommerce as a percentage of overall retail sales. What is astounding is that in a single eight-week period up to the end of May 2020, ecommerce has grown by the same amount as in the prior 10 years.

Established retailers are going bust every week and this is likely to get even worse as we go further into 2021.

- Cash reserves have been burnt

- Poor holiday trading was evident for many

- Normal trading will not return in 2021 even with a vaccine roll out

The latter will be caused by a combination of new habits sticking, ongoing safety issues for some and higher unemployment. So, even with a post-Covid increase in high street footfall, overall spend will still be lower than pre-Covid levels.

This chart shows that the situation in Europe is the same with online retailers making significant inroads in terms of market share. Something they will not give back without a fight.

Looking on the bright side – survivors will have significant growth opportunities

We see a significant opportunity to repurpose marginal retail space (edge of core areas, less trafficked streets, discount areas etc) for brown space residential development. This has the multiple benefits:

- It increases the number of people living in city centres. This brings them closer to retail outlets therefore boosting the ratio of outlets-per-person and therefore helping the retail that remains to thrive. We are already seeing this in certain communities but we predict this will be a much bigger trend moving forward.

- It allows us to quickly increase the housing stock due to the quicker planning times and less controversy that surrounds brown field development vs greenfield.

- It rebuilds communities, raises employment and drives increased spending in the area including retailers (see ’15-minute city’ further down)

In my view we shouldn’t be fighting this trend. There are important implications, such as reduced tax revenue locally (assuming the units are filled), although this should level out in the longer term due to increases in other taxes. The desire by many to preserve all the current retail stock is unrealistic given a shrinking market caused by a switch to other channels.

Instead of this happening through bankruptcies, dereliction and then eventual regeneration there should be town plans for a managed retreat. It will be quicker, less expensive and lead to better outcomes (the market will eventually get there but it will likely be a less optimal final distribution).

The opportunity for retail marketers #1:

Omnichannel has to be priority number one for retailers and marketers. Excelling at digital before the digital specialists master physical retail is the new arms race. Amazon has been leading the way with its purchase of Whole Foods but others will follow.

The endgame won’t be that all retail is online or visa versa. It will probably land close to the middle, driven by experiences across both. Physical retailers have many advantages over their pure-play online counterparts, unfortunately most of them don’t realise it yet.

2. The future of work will impact on retail

Prediction: remote working will continue to impact the way people buy.

Prediction: remote working will continue to impact the way people buy.

We cannot be 100% sure of what the post-Covid world will look like. But the increase in home working is very likely to stay with us. This has profound implications for many retailers.

Predicting what the post-Covid levels will be is tough. We believe there will be a significant increase in office days and commuting as we return to normality. But even a 20% fall from pre-Covid levels will be disastrous for many. And that number is probably optimistic, especially among high value consumers working in the knowledge economy. They tend to be older, live further out of town, can easily work from home and have family commitments that mean they benefit significantly from reduced commuting time.

This “donut problem”, where more people spend more time living on the ring while the middle is emptied out, may be a lasting legacy of the pandemic.

Most retailers work on tight margins. Even a small reduction in footfall would erode those margins leading to closures (see above) or significant reductions in costs. Those can only come from the supply chain, from employee costs or from fixed overheads such as rent and rates. In turn this will significantly impact the commercial real estate market which is likely to see a significant contracting in rental rates and occupancy over the coming 2-3 years.

The opportunity for retail marketers #2:

The opportunity for marketers is to understand this new normal and to adapt the products and services they offer to compete. With cost reductions likely to lag, the winners will be those that outcompete their competitors for share of attention and share of wallet. Companies should be looking a strategies around:

Loyalty: How can I get the same customer to come back more often?

Footfall: Can I introduce click and collect mechanisms for workers to make it easier to purchase in small shopping windows?

Organise for value: Can I create products that encourage pre-Covid behaviour. What have people been missing? After work drinks with an experience twist perhaps? Makeover evenings for cosmetic products?

Delivery: Some people, at least in 2021, may still be wary of busy public places. Delivery might make it easier to get a share of spend.

Out of town: With more workers at home, more purchases will be local? What are the opportunities?

Marketing: Do you need to change your media planning as commuter focused opportunities become less effective. Think outdoor media.

3. Local independents will experience a resurgence

Prediction: there will be an increased demand for local independent retail (in some categories) and locally-sourced products.

Prediction: there will be an increased demand for local independent retail (in some categories) and locally-sourced products.

This one is less clear. There is certainly a significant drive towards local and on the face of it, it makes a lot of sense. Support your local economies, shorten supply chains and therefore reduce environmental impact.

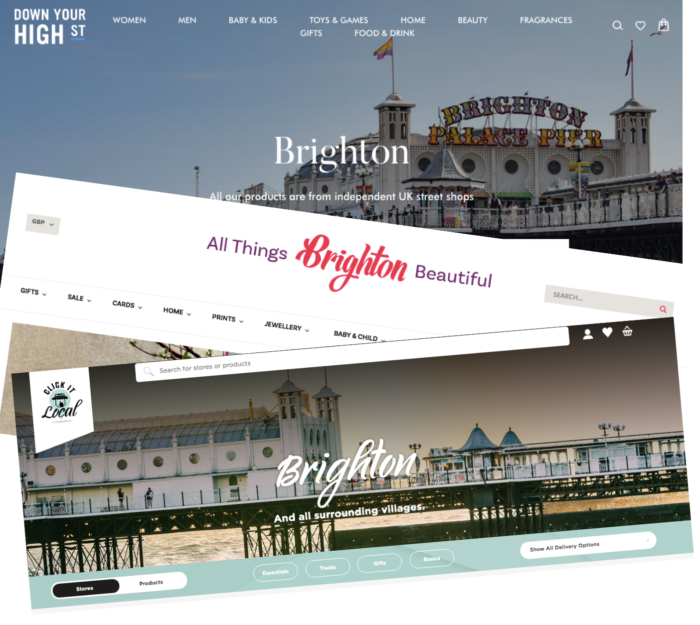

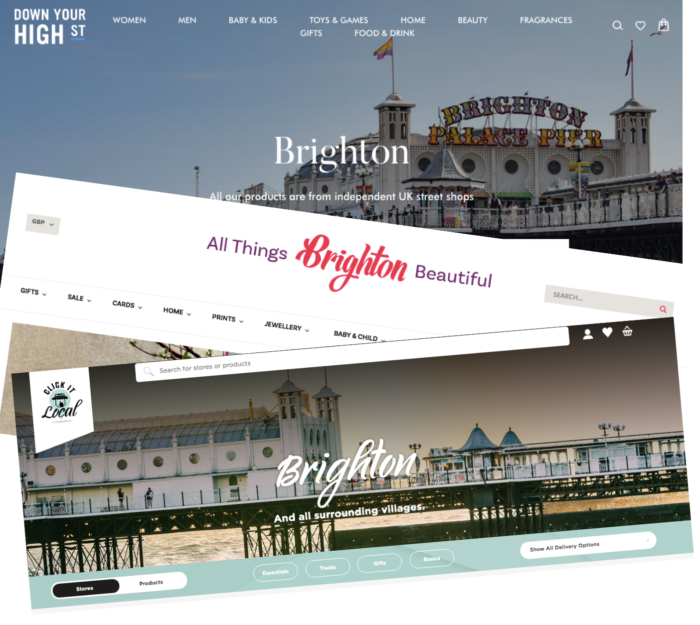

In my local town, admittedly a place where it seems ⅓ of the population under 40 are web designers, ⅓ “creators” and ⅓ DJ’s, local retail seems to be thriving. Below are three separate website portals which give customers the chance to buy locally in Brighton.

However, even though I like the idea and have used some of the sites mentioned, I’m not convinced it’s a home run. There are three main reasons:

- Price. It’s still prohibitively expensive vs the high street. This is due to a combination of sales volume, supply chain disadvantages and perceived value from the makers (though it’s fine for niche).

- Resources. Individual players lack the resources to be driving innovations especially around manufacturing or technology. However “consortiums’ are already appearing to aggregate expertise and share costs

- Competition. The big players, or at least the smart ones, will develop strategies to appear local if it’s a long-term a trend. They have managed to appear greener or more politically aware with some thought. They can pull the same trick with local too.

In some markets where there is a higher perceived value of locally produced goods. For example, customers are often prepared to pay more for fresh foods. But in many other segments this may be more challenging.

However innovation may well change this over the medium term as local supply chain management startups and processes improve. Likewise, technologies such as 3D printing should eventually become mainstream. There are already interesting initiatives in industries such as construction and several local authorities see this as key to economic growth.

Opportunity for marketers #3:

Retail marketing which has for decades looked for scale, needs to learn how to go local again, without losing the scale. Digital helps with its targeting capabilities, but new capabilities such as personalised print, local social and community engagement need to be learned and deployed.

4. The ethical consumer will be a key driver

Prediction: There will be an increased demand for ethical products and services.

The ethical consumer is not a new concept but it has largely been considered a niche, admittedly a rapidly growing one. In addition, while purchases of products considered ethical (Fairtrade, organic, free range etc) have risen quickly to over £40B in the UK alone, this doesn’t correlate to consumers being holistically ethical in their purchases. Convenience, single issue support and health are all significant reasons for these purchase decisions.

However this is changing with a growing number of consumers, especially Generation Z and Generation Y groups (10 – 40 years old), describing themselves as ethical first and deciding on ALL their purchases through this lens.

This demographic are already wielding significant economic power and will do increasingly over the next decade and beyond. New research seems to show that the Covid pandemic has actually accelerated the trend towards ethical products, something likely to stay even when things return to normal.

Gen Z and Y are also digital natives and well informed about issues and the companies they like and don’t like. They react badly to greenwashing and other attempts to paint an ethical picture on companies and products that do so for sales and not as part of their larger purpose.

To meet this demand there is a growing cohort of retailers focusing on this growing market. Such companies are leaving many traditional retailers behind. Ignoring this trend will be disastrous for the future growth of any retailer. (It’s also the wrong thing to do as without improved sustainability there will be no retail.)

These changes run deep covering supply chain, packaging, product sourcing, employee benefits, carbon contributions, recycling and end-of-life management of products – and a whole lot more.

It’s tempting for many companies to “greenwash” in order to fake their ethical status. Marketers will surely be asked to execute and communicate these messages but we would advise against this approach as the backlash if exposed can deliver a significant, lasting blow to a brand’s credibility. It’s fine to be on a journey, just be honest.

It’s tempting for many companies to “greenwash” in order to fake their ethical status. Marketers will surely be asked to execute and communicate these messages but we would advise against this approach as the backlash if exposed can deliver a significant, lasting blow to a brand’s credibility. It’s fine to be on a journey, just be honest.

Remember, you are being watched closely by an impassioned community of individual bloggers and green interest groups as well as mainstream media. Instead of faking it, companies need to change and innovate.

As the voice of the customer, marketing needs to take the lead on driving an understanding for why this change is no longer optional. As more businesses make commitments in this area, operating ethically and sustainably will be table stakes for consumers. For example some of the world’s largest football (soccer) teams are now starting to introduce sustainability programs, raising awareness on a scale rarely seen before.

Innovation is key. Ikea has started to rent furniture as well as selling it and are working hard on reducing the impact of the entire lifecycle of their products – from trees (they are one of the world’s largest consumers of wood), to final disposal via recycling.

Whole countries can become tainted, impacting supply chain decisions and encouraging production to be moved to locations which can guarantee the ethical approaches. China is one of those source countries under increasing pressure, which given the number of retailers who source their products there, is a considerable risk over the coming years.

Opportunity for marketers #4:

For marketing there needs to be ownership across the 4P’s (or 7) and not just Promotion. You are the voice of the customer and so you must drive the change in your business required to really meet the demands of the next generation of consumers. If you think Generation X are demanding, wait until Generation Alpha arrive – a generation born in digital – and raised in the age of Greta Thunberg. (And with a profound realisation that the time left for change is running out.)

“2020 saw a shift in focus away from environmental matters to those of health, but in 2021 the spotlight will no doubt pivot to sustainability once again. The most recent development in this space is with ASDA, which is trialling a sustainability store within one of its Manchester branches to encourage the public to re-use packaging as well as taking an eco-friendlier approach to shopping in general.

“An increasing number of consumers will expect their brands to step change their business models, introducing sustainable packaging solutions to eliminate plastics completely as well as introducing refillable/reusable packaging options for as many products as possible.”

– Lucy Hawkes, OMG Transact

5. D2C subscription services will continue to grow

Prediction: Direct to Consumer (D2C) services will continue to grow in popularity.

Prediction: Direct to Consumer (D2C) services will continue to grow in popularity.

Direct-to-Consumer (D2C) has been one of the hottest growth areas in retail for a few years but that trend is accelerating. As the name suggests, a D2C service cuts out the middle man and brings products straight to the door direct from the producer or manufacturer. This will have a profound effect on the future shape of retail.

Emarketer has stated that D2C e-commerce sales were $14.28 Billion in 2019 in the US alone and are set to reach $18 billion and $21 billion in 2020 and 2021, respectively.

D2C also has an upper hand when it comes to integrating transparency – which ties in with our thoughts above on the rise of the ethical consumer. Transparency is becoming more and more important for consumers. A study done by Label Insight reveals that nearly 39 percent of consumers will switch to a brand that is more transparent, and 56 percent of people say additional product information inspires more trust in a brand.

With a classic B2C retail model it can be hard to ensure and communicate transparency along the whole supply chain. A D2C model on the other hand can take a stronger position by implementing key technologies and engaging in direct communication with consumers. Everlane is an example of a brand which is implementing this strategy to the fullest. Not only do they show their factories behind the curtain, but they go so far as to even list the breakdown of their pricing model.

I personally use a wide variety of D2C services:

- I have milk (normally Oat), cheese and orange juice delivered via Milk & More. Yes just like the old milk subscription of yesteryear but better.

- For our dog food, sometimes topped up with dog treats we use tails.com, plus I have a subscription from Pets at Home for our dogs monthly medicine. I now rarely go to a pet store.

- Razors come from Harry’s.com. Cheaper, more convenient and unburdens me from the sponsorship costs of Roger Federer.

- Our dog grooming is also on a subscription and this is a very local one woman business. Pay monthly and get a discount, vs booking (and remembering) every 6-8 weeks.

There are more and this does not include significant software or entertainment subscriptions. We are currently either bundling our purchases with single providers (i.e. entertainment) or unbundling to get value or convenience (i.e. D2C consumer products).

In addition I have supermarket deliveries on all essential goods and then tend to shop locally for fresh top-ups or specialist items. This means I no longer visit the supermarket, reducing impulse buys and instead purchase only what I assume are lower margin essentials.

So why today, are there so few subscription services being offered by traditional retailers? The reasons seem clear:

- Denial – A prevailing view within the business that it is a fad that will have minimum impact. Remember Philip Green and his denial of digital channels?

- Delay – An inability or a lack of courage to make the required change. Most retailers rely on footfall to sell higher margin products and upsell the basket in store. The transition will be painful but the last to jump will almost certainly not make it across the chasm.

- Not in my market – “OK so it might work for dog food or razors but not for what I sell.” Truth is that Silicon Valley and its ilk around the world have targeted the low hanging fruit first. Easy to scale, high levels of friction in the market, scalable margins etc. But you could be next.

- Lack of expertise – This requires various new skills, which most retailers lack and smaller ones may struggle to finance – everything from Product Design to SaaS Marketing

- Lack of finance – Changing business models cost money which many retailers might struggle to raise while they bridge from one business model to another.

Let’s take some examples where subscriptions might work (remember everyone said that the categories already working wouldn’t when they first launched):

- Why are chemists not offering monthly care packages from an in-store kiosk?

- Why can’t I subscribe to razors in a store?

- When I buy a card in a shop (Birthday, Anniversary etc.) why is there no attempt to capture my details so that I can be added to an online system for reordering?

If you can define a regular cadence to any product that has utility value then a D2C model will work.

Opportunity for marketers #5:

Marketing needs to focus on omnichannel. In-store enablement of D2C would make it even more powerful, especially if you find ways to close the loop and drive customers back to the store from time to time. Marketers will need to learn new skills from the current crop of D2C businesses and adapt their marketing to meet this new market.

After all even cars are now becoming a subscription model – OK with financing they almost were already but Volvo are taking it one step further.

The data behind D2C

Read more about the growth of D2C:

6. The 15-minute city will become a reality

Prediction: the concept of a 15-minute city will become a reality.

Prediction: the concept of a 15-minute city will become a reality.

When we get asked about the future of retail we are asked to predict the longer term future. As discussed earlier this is a dangerous pastime fraught with danger. However one trend that we think will play out eventually is the concept of the 15 minute city – meaning as you might guess that all key amenities needed for day-to-day life are within a 15 minute walk.

Paris is leading the way but expect to see many other cities follow. This has profound implications for retailers as cities move to a human first approach to city planning – and that includes discouraging cars, especially larger ones, as a transport

option. More retail will be local using smaller retail units. Retail units may even be shared in the way that bookstores and coffee shops do today. Large retail parks on the outskirts of towns will exist for larger goods and potentially as delivery hubs for local retailers or ecommerce.

Of course there are many challenges ahead. For example infrastructure needs to be improved. Especially in lower density areas or poorer neighbourhoods. Plus, delivery mechanisms need to ensure that new green cities are not clogged up with lorries and other delivery vehicles.

However it makes sense – more sustainable, better for humans, community first and more.

Opportunity for marketers #6:

For marketing there are also significant challenges should we end up going in this direction. Brands that rely on scale will find it harder to market broadly. Personalization and product/brand differentiation will be key. Community marketing and small scale social will be vital.

Conclusion: The future of retail could be bright

The future could be very very bright. The changes that are coming could lead to the reinvention of retail and its role in our communities. It could continue to employ the millions it does today while contributing to the finances of this and every country through fair taxation, and it could do so while reducing the environmental impact of the sector significantly.

To participate in the conversation join our GMA community and participate in this discussion.

Leave your thoughts